41+ when can i get rid of mortgage insurance

Web Lenders are typically required to remove private mortgage insurance from your loan when your home equity reaches 22. Call us at 1-800-357-6675 if you have questions about removing your MIP and one of our customer.

When Can I Remove Private Mortgage Insurance Pmi From My Loan Forex Trading And Strategy

Mip Cancellation How To Remove Fha Mortgage Insurance In 2022 Web Get.

. Web Conventional mortgage lenders must eliminate insurance when the borrower has 22 equity in the home. Your annual MIP will go away on its. Your lender or servicer is required to cancel PMI on your conventional mortgage once your principal loan balance reaches 78 of the original.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web You can avoid paying for private mortgage insurance or PMI by making at least a 20 down payment on a conventional home loan. Web When I can get rid of mortgage insurance.

Some or all of the mortgage. If your loan balance has reached the 8020 LTV mark contact your mortgage servicer and ask them to remove the mortgage. Web If you purchased a home with less than 20 down chances are good you are paying private mortgage insurance PMIPMI is tacked onto your monthly mortgage.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. For example if you have a 250K home loan that will equal anywhere from. If interest rates have dropped since securing your current mortgage then refinancing could save you money.

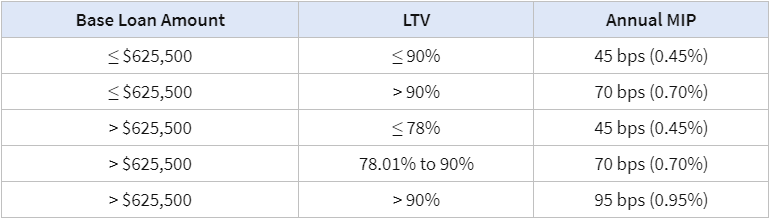

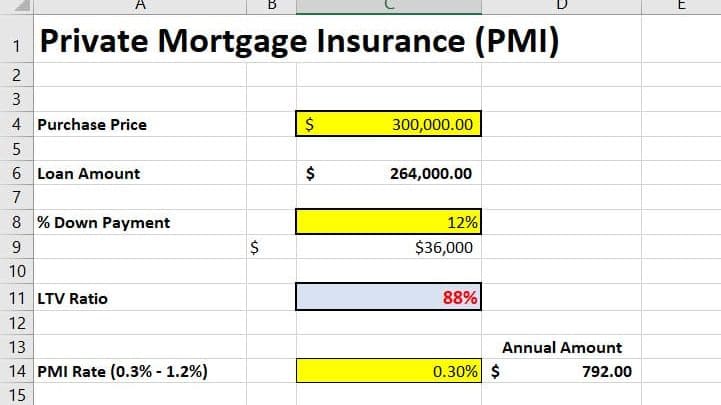

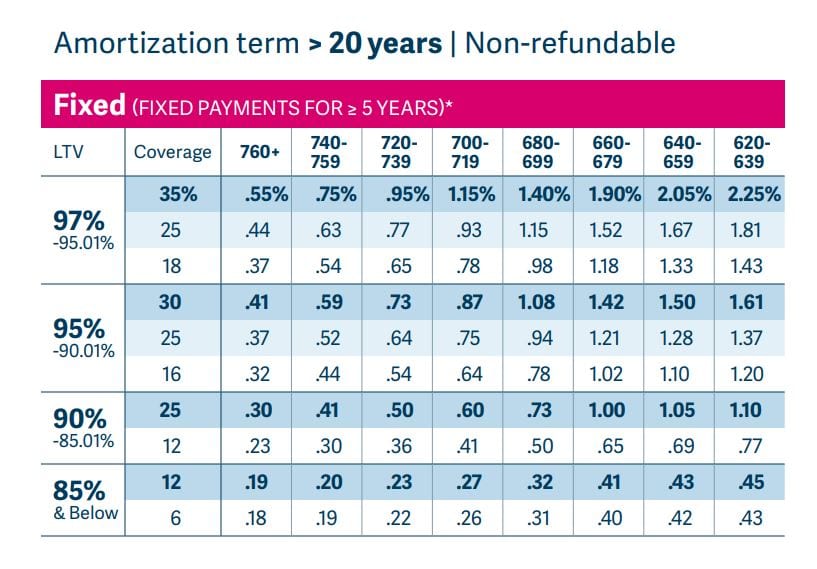

Web The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to the Urban. Web Private mortgage insurance or PMI is a big cost for homeowners often 100 to 300 per month. Web Applied after June 2013 and your loan amount was greater than 90 LTV.

Ad Veterans who are eligible for a VA Home Loan pay No PMI. There is another option you can pursue to remove mortgage insurance from your life. Web As a rule you can expect to pay 05 to 1 of your total loan amount per year in mortgage insurance.

Web Typically lenders require a minimum loan-to-value ratio the total amount borrowed divided by the value of the property of 80 before PMI can be removed. Web Some FHA loan holders can get rid of their mortgage insurance premiums without refinancing. Homeowners can implement strategies to get out.

Web By switching into a conventional loan youll be eligible to cancel mortgage insurance when you reach 80 LTV or if youve already hit 80 LTV you wont have. Refinance to get rid of mortgage insurance. Put 10 percent or more down.

Web If youd like to get rid of MIP you have two options. Alternatively you can refinance. Ad Veterans who are eligible for a VA Home Loan pay No PMI.

You can make a down payment of 10 or more and be MIP-free after 11 years. So if you dont ask your lender to get rid of your PMI. If the market value of your home has appreciated.

Web Bottom line.

Mortgage Insurance When Do You Need It New Dwelling Mortgage

How To Get Rid Of Pmi Nerdwallet

Understanding Mortgage Insurance Home Loans

How To Get Rid Of Pmi Nerdwallet

Syjty4kvt29oum

How To Calculate Private Mortgage Insurance Pmi Excelbuddy Com

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

When Can You Eliminate Mortgage Insurance Usdaloan Org

How To Get Rid Of Pmi Nerdwallet

How To Get Rid Of Mortgage Pmi Payments Bankrate

How To Get Rid Of Pmi Nerdwallet

.jpg?lang=en-US&ext=.jpg)

When Can I Remove Private Mortgage Insurance Pmi From My Home Loan

How To Calculate Mortgage Insurance Pmi 9 Steps With Pictures

Mortgage Insurance What It Is And When It S Required Forbes Advisor

What Is Mortgage Insurance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

For Sale 18 Old Cary Road Anza Ca 92539 Unreal Estate

Kimberly Monroe Fowler Retired After 41 Years Yeeeehaaaa Genworth Mortgage Insurance Linkedin