23+ how to assume mortgage

Ad Register for Instant Access to Our Database of Nationwide Foreclosed Homes For Sale. Web A home loan assumption allows you as the buyer to accept responsibility for an existing debt secured by a mortgage on the home youre buying.

How To Assume A Mortgage 10 Steps With Pictures Wikihow

300 and a 05 funding fee paid by either the buyer.

. Web To assume a mortgage youll take many of the same steps you would if you applied for a new mortgage including completing an application and letting the lender. Web You will need to complete an application provide credit and financial documents and get approved by the sellers lender to assume a mortgage. Web One option for home buyers is to use a home equity loan to supplement the down payment on an assumable mortgage.

This involves taking out a second. Request an application from the lender. You typically have to pay closing.

Web The maximum allowable fees for FHA and VA loan assumptions are listed below. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

Web Put simply an assumable mortgage is any home loan that allows a new borrower to take over an existing mortgage from the original borrower. Select Popular Legal Forms Packages of Any Category. All Major Categories Covered.

Web 30-year mortgage refinance retreats --002. In order to assume a mortgage you must qualify with the current lender. Web An assumable mortgage allows a buyer to assume the current principal balance interest rate repayment period and any other contractual terms of the sellers.

Ad Compare Top Mortgage Lenders 2023. Web ASSUMING THE MORTGAGE 1. In this guide well cover everything you need to.

HUD Homes USA Can Help You Find the Right Home. Compare a Reverse Mortgage with Traditional Home Equity Loans. Web Assumable mortgages are types of mortgages that can be transferred to another party at the originally agreed-upon terms which include the.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Assumable Mortgage. Web An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage.

Web An assumable mortgage is simply put one that the lender will allow another borrower to take over or assume without changing any of the terms of the mortgage. Web Assumable mortgages typically work by contractual agreement for a mortgage repayment of the property loan including the interest rates closing costs in. 6 Without the lenders.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Compare Apply Directly Online. Web 17 hours agoBased on data compiled by Credible mortgage refinance rates have fallen for all key terms since last Friday.

An assumable mortgage is a type of financing arrangement in which an outstanding mortgage and its terms can be transferred from. Web Assumable mortgages allow you to buy a house by taking over the sellers mortgage rather than getting a new mortgage to purchase the property. The average 30-year fixed-refinance rate is 703 percent down 2 basis points over the last seven days.

Assumable Mortgages Explained Youtube

How An Assumable Mortgage Works Process Pros Cons

How To Manage And Deal With Credit Card Debt

5 Tips For Assuming A Mortgage From A Family Member

Housing In Ten Words The Baseline Scenario

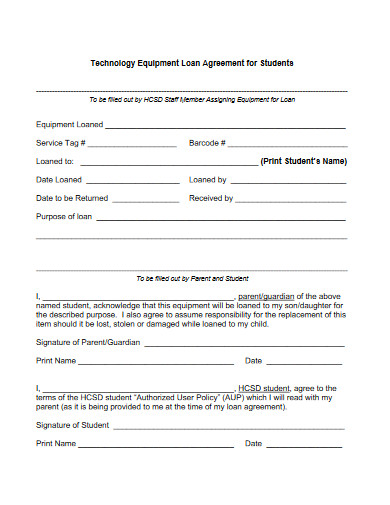

Equipment Loan Agreement 10 Examples Format Pdf Examples

Mortgages How To Assume A Mortgage Youtube

Can I Assume The Existing Mortgage

Modeling A Mortgage Loan Assumption Using The All In One Adventures In Cre

How To Assume A Mortgage 10 Steps With Pictures Wikihow

2021 The Second Wave Of Fintech Disruption Trends To Watch Out

What Does It Mean To Assume A Loan How Do You Model It Real Estate Financial Modeling

10 Tips For Assuming A Mortgage How To Assume Mortgages Realestate Loans Leland Baptist Youtube

How To Assume A Mortgage Superior Mortgage Co Inc

How To Assume A Mortgage Superior Mortgage Co Inc

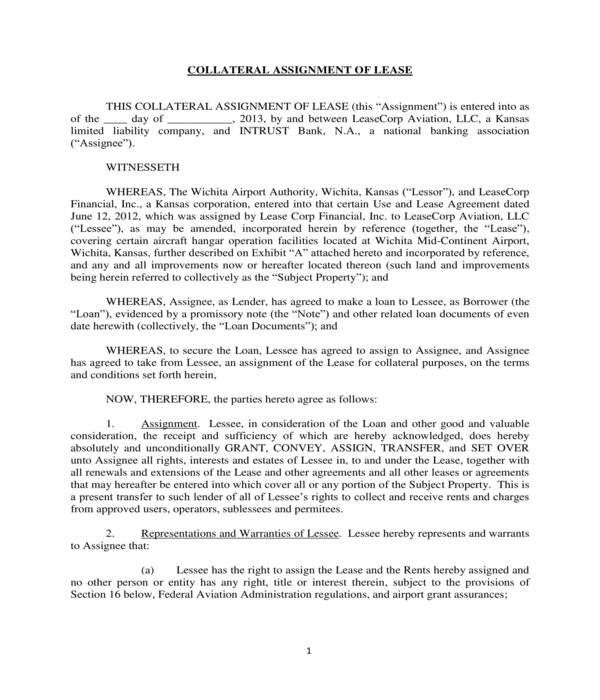

Free 7 Assignment Of Lease Forms In Pdf Ms Word

How To Plan For Unexpected Expenses Wealth Mode Financial Planning