Pre tax profit margin calculator

Lets say that your business took 400000 in sales revenue last year plus 40000 from an investment. How to calculate profit margin.

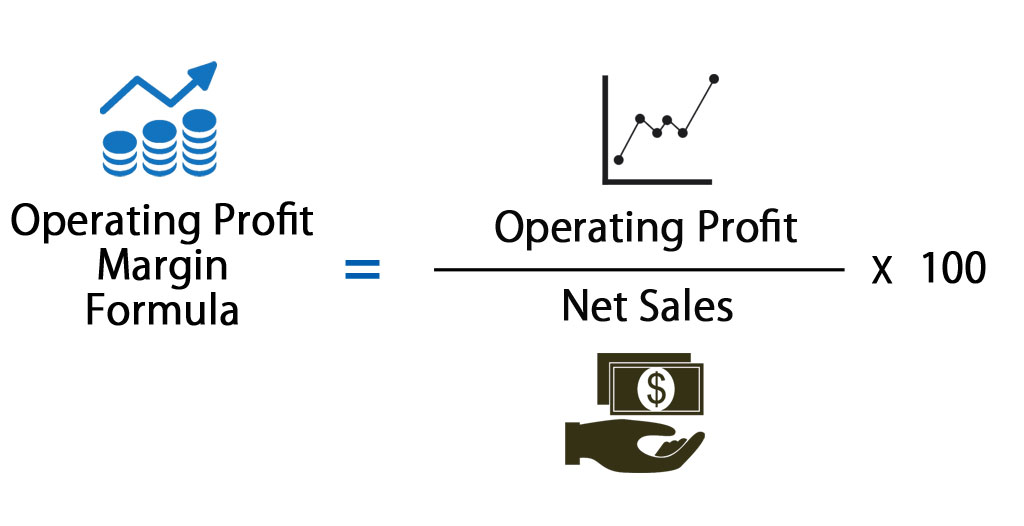

Operating Profit Margin Formula Calculator Excel Template

Find out your revenue how much you sell these goods for for example 50.

. Pretax profit margin Pretax profit. Margin rates as low as 283. You then divide your pre-tax earnings and gross.

How to calculate Operating Profit Margin. The Pretax Margin measures how well a company can generate before-tax profits at the current level of sales. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

Find great deals on Pre tax profit margin calculator Calculators including discounts on the Canon 10-Digit Calculator Dual Power4x5-13x1-15 - 1SPR-CNMLS100TS. Pre-tax profit margin can be defined as. After deducting the health.

50000 30000 20000. Rates subject to change. Margin rates as low as 283.

Pretax profit margin is a companys earnings before tax as a percentage of total sales or revenues. Current and historical pre-tax profit margin for Amazon AMZN from 2010 to 2022. Where PP Pretax Profit.

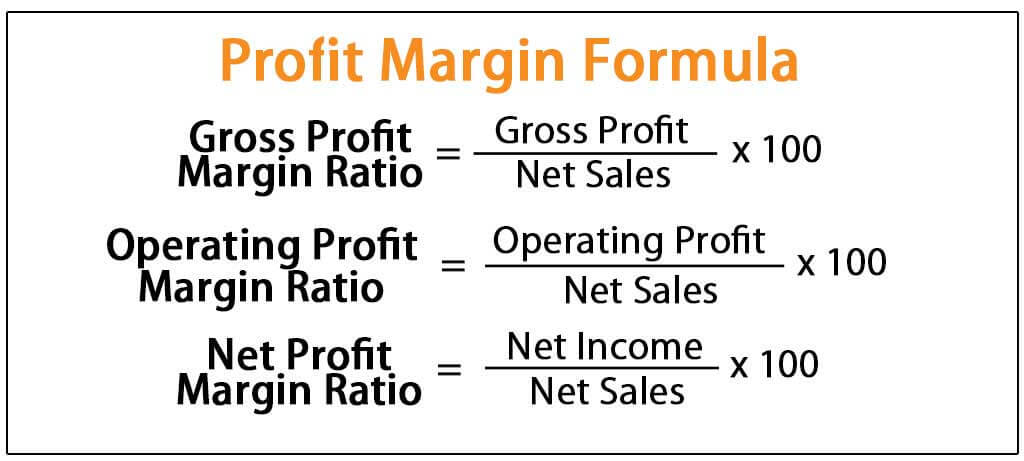

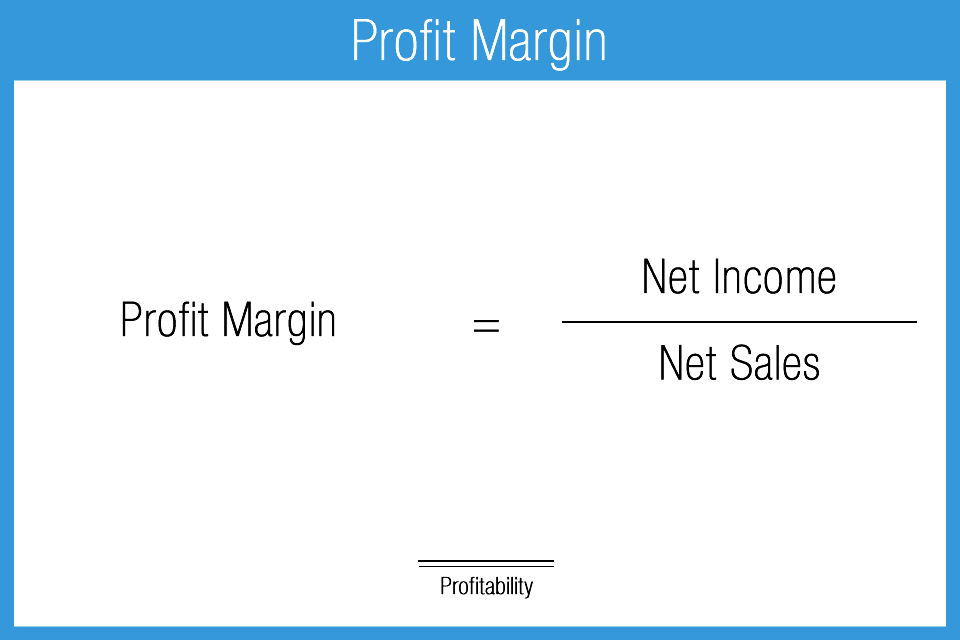

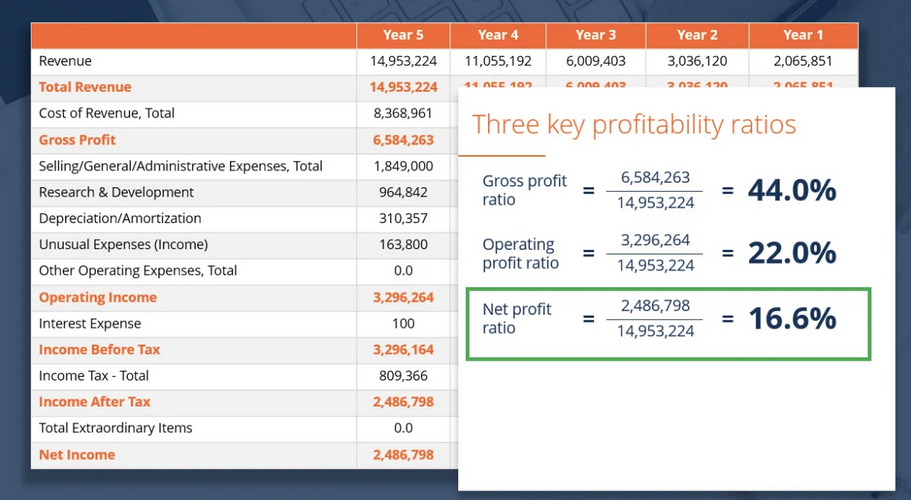

The net profit margin is net profit divided by revenue or net income. 30000 50000 x 100 60. Example of net profit margin calculation.

Sckit01 Calculate Pretax Margin. The net profit margin formula. S Net Sales.

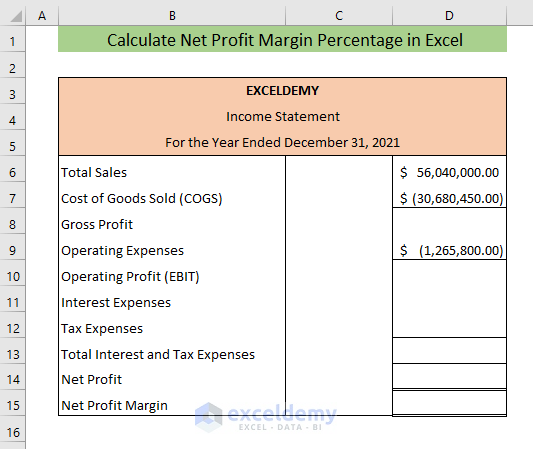

The net profit margin is determined by dividing net profit by total revenues in the following way. Net profit margin net profit total revenues. Its computed by getting the total sales revenue and then subtracting the cost of goods sold operating.

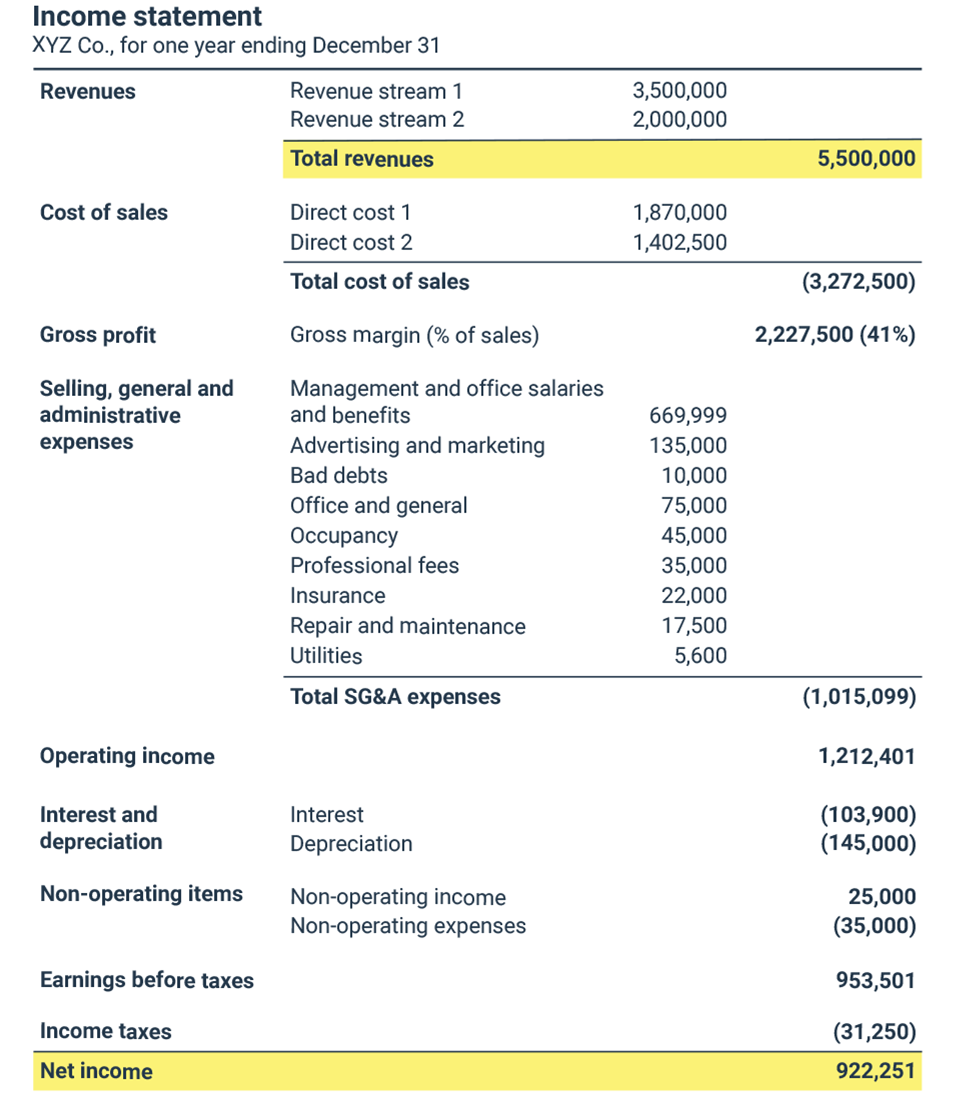

Actual Cost Of Pre-Tax Contributions. Find out your COGS cost of goods sold. You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit.

Rates subject to change. In real terms this means that every 1 of sales resulted in 060 of retained profit. 17000 X 765 13005.

EBT ratio 100 EBT R EBT ratio 100 E B T R. Work out your own business net profit. How to calculate pre-tax health insurance.

You had total expenses of 300000. Calculate the net profit margin net profit and profit percentage of sales from the cost and revenue. The higher the pretax profit margin the more profitable the company.

Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. EBITDA 60 million. Contrary to EBIT the PBT method accounts for the interest expense.

What is the pre-tax profit margin. Heres the formula for calculating pre-tax profit margin Profit Before Tax Net Sales Pre-Tax Profit Margin Example. 1000 10000 10 Pre-Tax Profit Margin.

Using those assumptions we can calculate the profit metrics that will be part of our margin calculations. Gross Profit 100 million 40 million 60 million. Pretax Profit Margin PP S.

Net profit margin. So first we calculate it by subtracting gross profit by operating expenses and then we add the result with non-operating profit loss.

Gross Profit Margin Best Sale 58 Off Www Wtashows Com

Net Profit Margin Formula And Ratio Calculator Excel Template

Performance Profits How To Calculate Your Small Business S Margin Mila Lifestyle Accessories

How To Calculate Net Profit Margin Percentage In Excel Exceldemy

Pretax Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Calculator Bdc Ca

Net Profit Margin Formula And Ratio Calculator Excel Template

Profitability Ratios Accounting Play

Net Profit Margin Calculator Bdc Ca

Profit Margin Formula And Ratio Calculator Excel Template

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Operating Profit Margin Formula Meaning Example And Interpretation

Profit Before Tax Formula Examples How To Calculate Pbt

Pretax Profit Margin Formula Meaning Example And Interpretation

Guide To Profit Margin How To Calculate Profit Margins With Examples

Pretax Profit Margin Formula Meaning Example And Interpretation

Pretax Profit Margin Formula Meaning Example And Interpretation