Easy payroll calculator

Remote is your local expert for international employee benefits. Heres a step-by-step guide to walk you through.

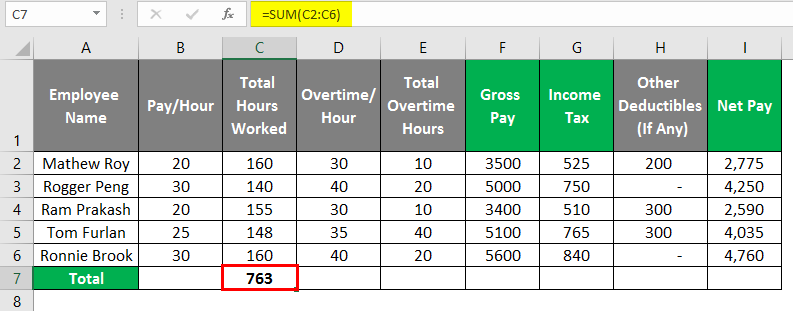

How To Prepare Payroll In Excel With Pictures Wikihow

Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques.

. For example if you earn 2000week your annual income is calculated by. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Add pretax 401k eg non-tax POP or after-tax.

3 Months Free Trial. Ad Process Payroll Faster Easier With ADP Payroll. Start Afresh in 2022.

Salary commission or pension. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. All inclusive payroll processing services for small businesses.

Get Started With ADP Payroll. Need help calculating paychecks. The state tax year is also 12 months but it differs from state to state.

The tool then asks you. Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. Leading EOR offering global payroll benefits and compliance.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Pay 0 upfront all monthly. Free Unbiased Reviews Top Picks.

Ad Run Easy Effortless Payroll in Minutes. Add overtime bonus commission or any earning items. Find out how easy it is to manage your payroll today.

Starting as Low as 6Month. Federal Salary Paycheck Calculator. Withhold 62 of each employees taxable wages until they earn gross pay.

Find Easy-to-Use Online Payroll Companies Now. Supports hourly salary income and multiple pay frequencies. How to use a Payroll Online Deductions Calculator.

Small Business Low-Priced Payroll Service. No Need to Transfer Your Old Payroll Data into the New Year. If youre looking to calculate payroll for an employee or yourself youve come to the right place.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Growing a global team. Input the date of you last pay rise when your current pay was set and find out where your current salary has.

Taxes Paid Filed - 100 Guarantee. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

You first need to enter basic information about the type of payments you make. Ad Modern teams use Remote. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Payroll management made easy. This Payroll Calculator Excel Template supports as many employees as you want. Pay more upfront less monthly.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Computes federal and state tax withholding for. It originated in the 19th century and has stayed essentially the same.

The calculator is updated with the tax rates of all Canadian provinces and. Taxes Paid Filed - 100 Guarantee. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Everything You Need For Your Business All In One Place. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Ad Process Payroll Faster Easier With ADP Payroll. Flexible simple payroll tax and deduction calculations. Features That Benefit Every Business.

8 FREE payroll calculators for you and your employees. Get Started With ADP Payroll. Approve Hours Run Payroll in App.

Fast easy accurate payroll and tax so you save. In addition to this our Paycheck Tracker has a dashboard to see cumulative earnings as well. You can use the calculator to compare your salaries between 2017 and 2022.

This free easy to use payroll calculator will calculate your take home pay. Ad Payroll Doesnt Have to Be a Hassle Anymore. Get a free quote today.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Easy To Run Payroll Get Set Up Running in Minutes. Whether its W-4 deductions gross-up or.

The paycheck is one of the most basic forms of monetary compensation for work. Payroll So Easy You Can Set It Up Run It Yourself. Hourly Paycheck and Payroll Calculator.

Get a free quote today. Some states follow the federal tax. Decide how much you pay upfront and per month.

Ad Compare This Years Top 5 Free Payroll Software. Based Specialists Who Know You Your Business by Name. Use this calculator to see how inflation will change your pay in real terms.

Ad Accurate Payroll With Personalized Customer Service. Ad Payroll Made Easy.

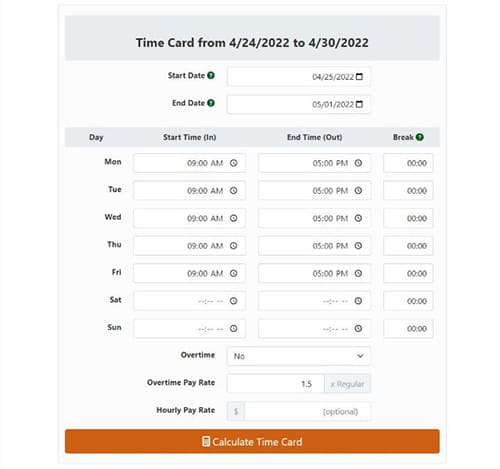

Easy To Use Time Card Calculator For Payroll Payroll Tracking App Good Employee

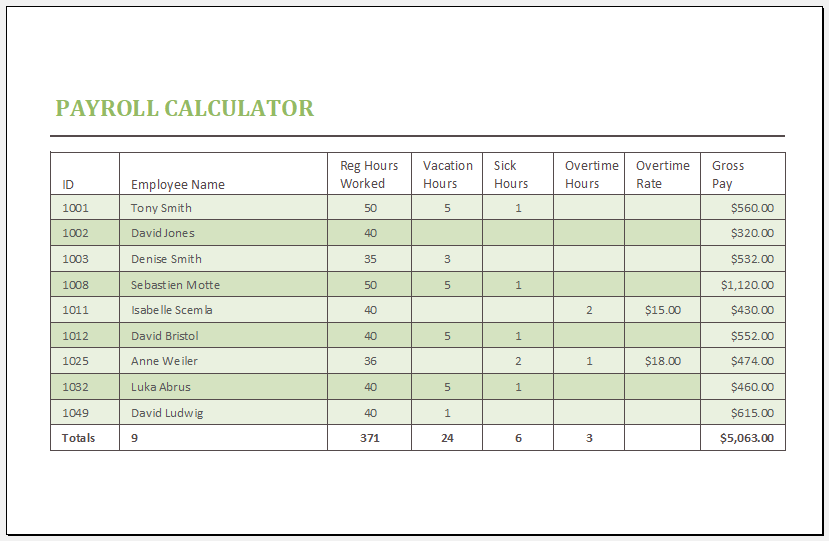

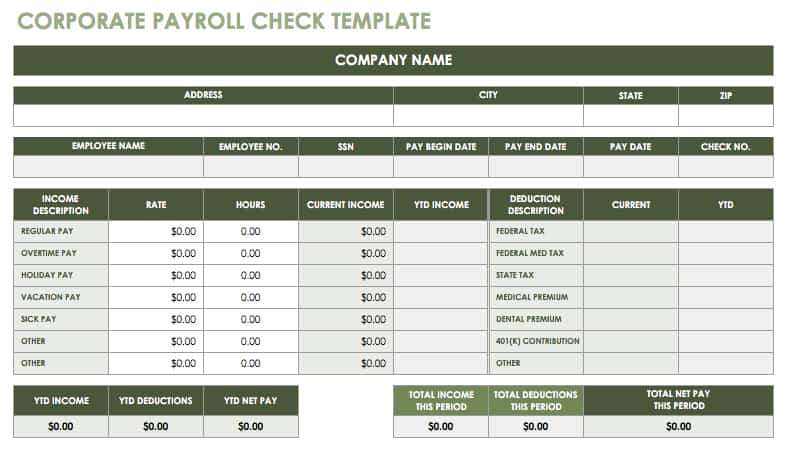

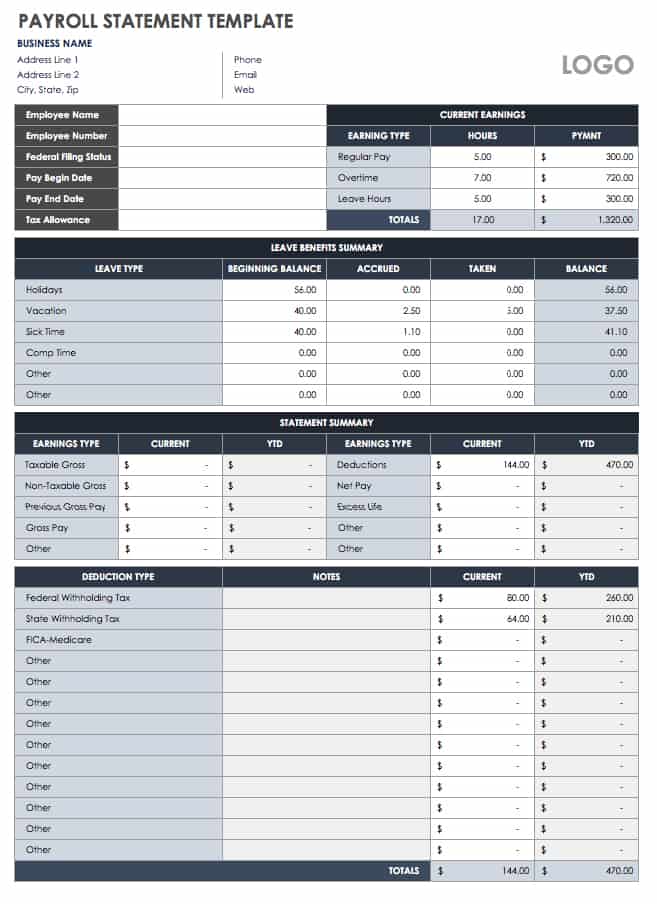

Payroll Template Free Employee Payroll Template For Excel

20 Best Time Card Calculators For Managers Getsling

Payroll Calculator Template For Ms Excel Excel Templates

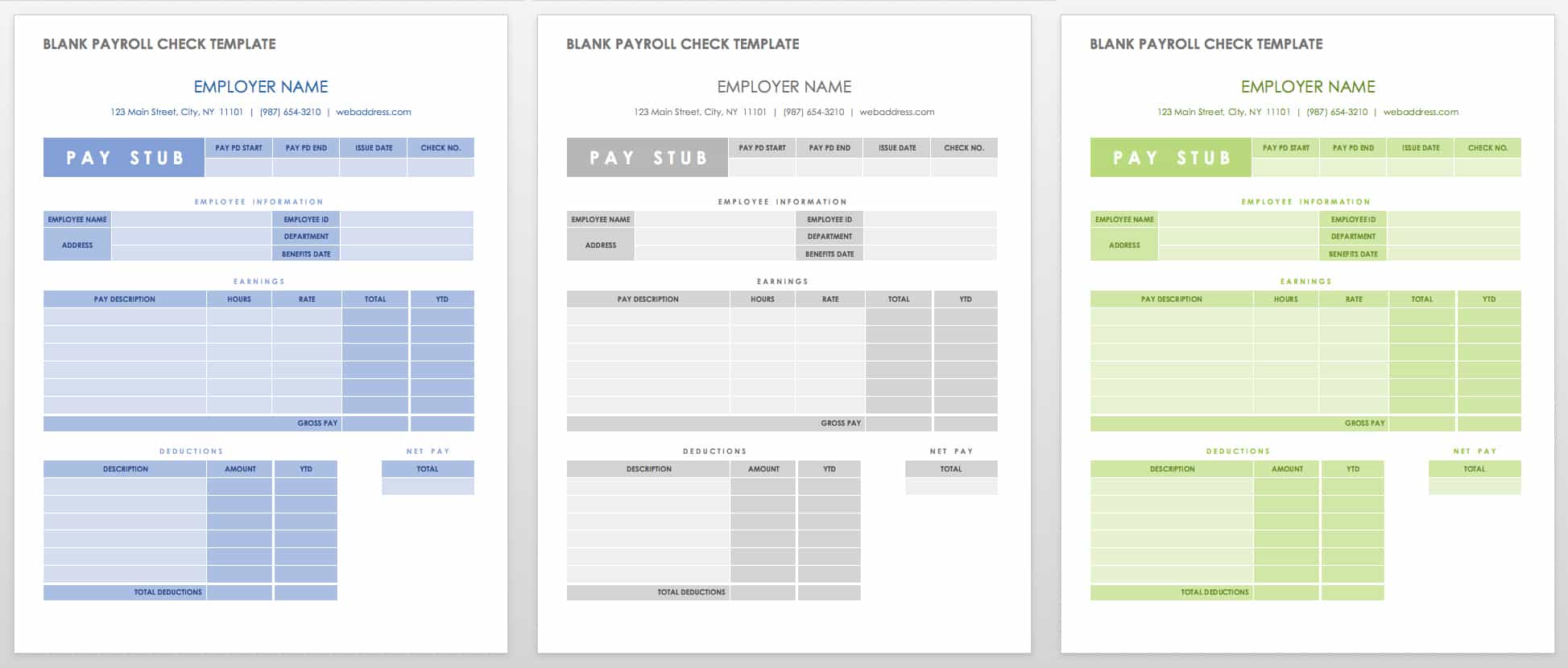

15 Free Payroll Templates Smartsheet

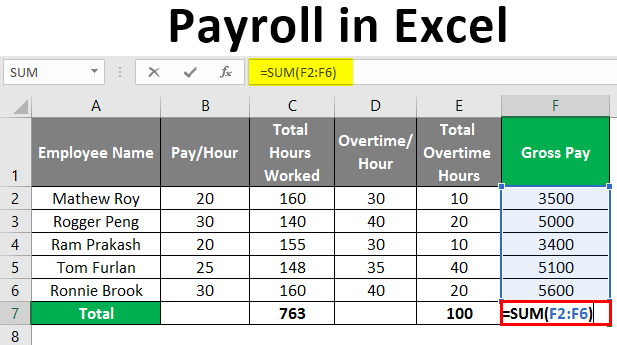

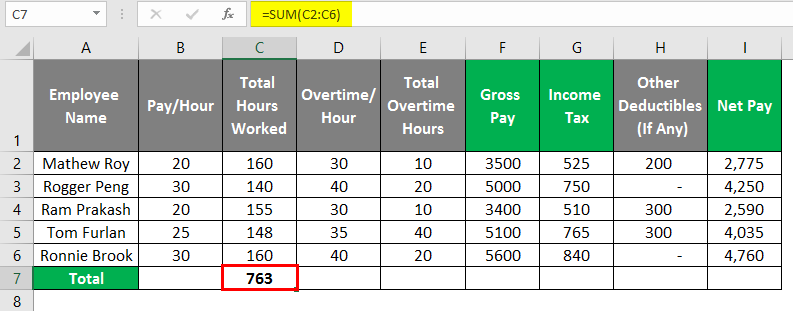

Payroll In Excel How To Create Payroll In Excel With Steps

15 Free Payroll Templates Smartsheet

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Payroll Time Conversion Chart Payroll Calculator Conversion Chart

15 Free Payroll Templates Smartsheet

Payroll Deductions Calculator Top Sellers 50 Off Www Ingeniovirtual Com

15 Free Payroll Templates Smartsheet

Payroll Calculator With Pay Stubs For Excel

How To Prepare Payroll In Excel This Wikihow Teaches You How To Calculate Payroll For Your Employees In Microsoft Excel Creating A Payro Payroll Excel Salary

Payroll In Excel How To Create Payroll In Excel With Steps

How To Prepare Payroll In Excel With Pictures Wikihow

Payroll Template Free Employee Payroll Template For Excel